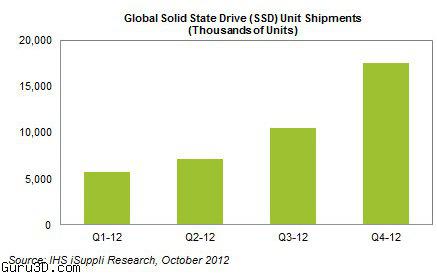

IHS iSuppli has issued a report on solid state disk shipments. The end conclusion is simple, the disappointing ultrabook shipments won't stop the success of SSD shipments in 2012. Shipments of SSDs are rising exponentially, they're anticipated to hit 17.5 million units in the current quarter, more than the first two quarters of the year combined. The current shipment forecast is lower than the prior one though, iSuppli previously anticipated 20 million SSDs would ship in the fourth quarter.

Although the near-term prospects for ultrabooks have dimmed significantly, the solid state drives (SSDs) employed by these next-generation notebooks and other products are so diversified in their uses and so compelling in their value proposition that their growth outlook has decreased only slightly.

SSD shipments in the first half of this year amounted to 12.9 million units, according to the IHS iSuppli Memory & Storage Service at information and analytics provider IHS (NYSE: IHS). Shipments reached 10.5 million in the third quarter and will rise to 17.5 million units in the fourth, amounting to a total of 28.0 million units in the second half—more than double the total shipped during the first six months of the year, as shown in the figure below. This is down from the previous forecast of 13.0 million in the third quarter and 20.0 million in the fourth.

The shipment numbers cover pure standalone SSDs—i.e., units with no hard disk drives (HDDs) associated with them—as well as when the drives are used with HDDs as separate cache SSD entities. These numbers cover all applications for SSDs, including the enterprise segment, ultrabooks and other so-called ultrathin computers.

“Intel Corp. has not matched its ambitious goals for ultrabooks with the marketing needed to propel the platforms as a desirable, affordable alternative to conventional notebooks and tablets,” said Ryan Chien, analyst for memory and storage at IHS. “This has prompted IHS to lower its cache SSD shipment projection. However, pricing for SSDs has fallen well below the $1-per-gigabyte threshold, making their value proposition more attractive than ever. Because of this, SSDs are finding uses in other products, helping to compensate for the shortfall in ultrabooks.”

Aggressive Long-term Outlook

IHS is maintaining an aggressive long-term outlook for SSDs due to NAND die shrinks, increasing utilization of TLC flash, and controllers with more advanced flash management techniques that are accelerating the cost curve.

The second quarter of the year closed with 7.1 million SSDs being shipped for $1.5 billion in revenue.

And although cache SSDs undershot expectations, traditional SSDs—including those for the enterprise market—with their higher prices helped make up the revenue slack. By the second half of this decade, SSDs will be a de facto standard in non-budget notebook and desktop PCs, thanks to a mixture of lower prices, consumer education and an optimized software ecosystem.

IHS projects the SSD industry will finish 2012 with $7.5 billion in revenue and 41.0 million in shipments, with compound annual growth rates of 35 percent and 69 percent, respectively.