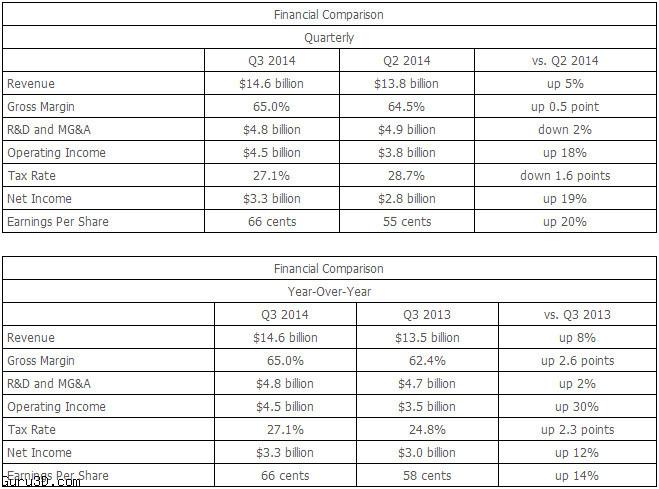

Good times for Intel as they reported third-quarter revenue of $14.6 billion, operating income of $4.5 billion, net income of $3.3 billion and EPS of $0.66. The company generated $5.7 billion in cash from, paid dividends of $1.1 billion, and used $4.2 billion to repurchase 122 million shares of stock.

"We are pleased by the progress the company is making," said Intel CEO Brian Krzanich. "We achieved our best-ever revenue and strong profits in the third quarter. There is more to do, but our results give us confidence that we're successfully executing to our strategy of extending our products across a broad range of exciting new markets."

- PC Client Group revenue of $9.2 billion, up 6 percent sequentially and up 9 percent year-over-year.

- Data Center Group revenue of $3.7 billion, up 5 percent sequentially and up 16 percent year-over-year.

- Internet of Things Group revenue of $530 million, down 2 percent sequentially and up 14 percent year-over-year.

- Mobile and Communications Group revenue of $1 million, consistent with expectations.

- Software and services operating segments revenue of $558 million, up 2 percent sequentially and up 2 percent year-over-year.

Business Outlook

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after October 14.

Q4 2014

- Revenue: $14.7 billion, plus or minus $500 million.

- Gross margin percentage: 64 percent, plus or minus a couple of percentage points.

- R&D plus MG&A spending: approximately $4.9 billion.

- Restructuring charges: approximately $45 million.

- Amortization of acquisition-related intangibles: approximately $65 million.

- Impact of equity investments and interest and other: approximately $175 million net gain.

- Depreciation: approximately $1.9 billion.

- Tax rate: approximately 28 percent.

- Full-year capital spending: $11.0 billion, plus or minus $500 million.